When considering whether it is the right time to purchase a home, there are many factors beyond the interest rate that will determine the overall price.

Interest rates came down slightly at the beginning of October to 6.83% after moving to over 7% at the end of September. During the second week of October, rates rose again above 7%. This was due to the Federal Reserve increasing the rate three-quarters of a percentage point. Lenders are preparing for another rate hike at the beginning of November.

The FED began increasing its benchmark interest rate in March as a way to reduce inflation. This has led to higher borrowing costs for homebuyers. In 2020, interest rates were reduced to historically low levels because of the pandemic. Many buyers are comparing today’s rates to the rates two years ago, which is really not realistic.

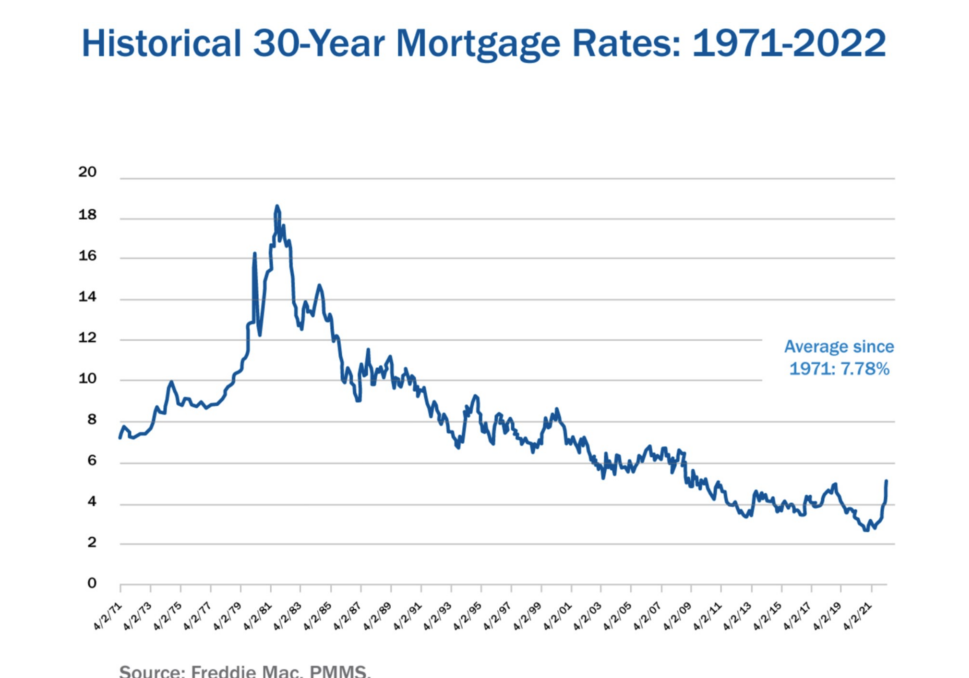

To keep rates in perspective, the chart below shows that since 1971, interest rates have averaged 7.78%.

Interest Rates and Sales Price

It is true that a $300,000 mortgage with a 2% difference in the interest rate will increase the monthly payment a few hundred dollars. For example, at 3.5%, the payment would be $1,347 vs $1,703 at an interest rate of 5.5%.

What is happening in the real world however, is that as many buyers back away from buying a home because of rising interest rates, home prices have begun to adjust down. Even at a higher interest rate, the overall cost of a home can actually be reduced by a lower purchase price.

Many buyers are considering an adjustable-rate loan to obtain a lower mortgage rate for five or seven years. Zillow reported that 12% of mortgage loans in June and July were for adjustable-rate loans.

These types of loans can be risky because the monthly payment can increase depending on where mortgage rates are after the initial term. A borrower who locks in a fixed rate loan at a higher interest rate today, can always refinance if interest rates come back down.

Why Buying a Home Today Makes Sense

As the real estate market continues to fluctuate, many would-be homebuyers have sat on the sidelines waiting for a lower rate. Those who have chosen to move forward have been rewarded by a lower purchase price.

Those who are waiting – are still waiting.

Even if interest rates were to adjust down, the current buyer’s market could quickly revert back to a seller’s market as pent-up buyer demand floods the market. Home prices could rise again.

Many sellers are now offering to pay for a 2-1 buydown on the rate. Buyers can enjoy a 2% lower rate the first year and a 1% lower rate the second year, before locking into the prevailing rate. If after 2 years, interest rates do indeed come down, they can refinance.

While your borrowing costs may be higher, the purchase price of an available home can be lower. There are also strategies for sellers that can help them hold to their asking price. If you are thinking of buying or selling your home at Lake Tahoe or Truckee, contact me today to discuss the best strategy.

Leave a Reply