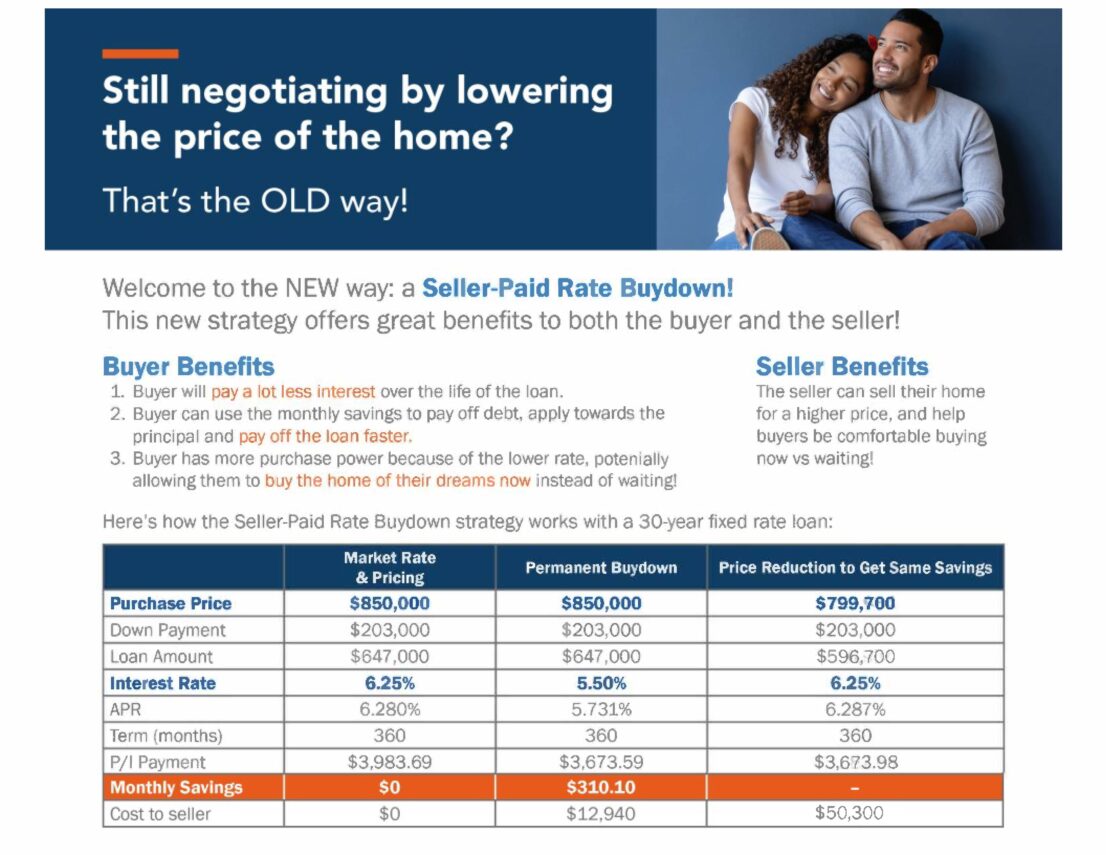

Mortgage companies are getting creative to help buyers with affordability, while allowing sellers to avoid price reductions. Here’s how it works:

Buyers have been challenged by rising interest rates and home prices. A one percent rise in an interest rate can increase the monthly payment beyond what a buyer can afford.

As buyers remain on the sidelines, wondering where interest rates will settle, sellers are facing shrinking demand and are forced to accept a lower offer on the sale of their home.

Typically, a buyer will pay closing costs and fees to obtain a mortgage. These costs can range between 3% – 6% of the sales price. Today, many sellers are more willing to pay for these upfront fees, which is called seller concessions.

This can be a win/win for both the buyer and seller. In return for paying some of the upfront costs on the buyer’s loan and closing, a seller can retain a higher sales price.

Possible Costs Paid by Seller

Title Insurance: Normally this is paid by the buyer as protection on any claims against the title.

Inspections: Lenders require some inspections that are normally paid by the buyer.

Property taxes: A seller can pre-pay property taxes through the end of the year.

Loan Origination Fees: This is the fee the lender charges the buyer to process the loan.

Appraisal: Lenders require a fee to cover having a licensed appraiser estimate the home’s value.

Points: Lenders allow buyers to pay upfront interest to reduce the overall interest rate.

When the seller pays for any of the above costs, the amount a buyer needs to cover the purchase is greatly reduced. When a seller offers to pay points to reduce the buyer’s interest rate, this can make a difference in whether the buyer can afford the monthly payment.

The sales price no longer needs to be reduced and everybody gets exactly what they need.

Contact me today to learn more about these exciting mortgage programs. Whether you are buying or selling your home, I can negotiate the transaction as a win/win for both buyers and sellers.

Leave a Reply